A private loan is a kind of unsecured credit that allows individuals to borrow a selected amount of money from financial establishments or lenders. Unlike a mortgage or auto loan that is backed by collateral, personal loans do not require any asset to be pledged. This implies that debtors can use the funds for quite so much of functions, such as home renovations, medical bills, or vacations. The mortgage quantity usually ranges from a few hundred to tens of 1000's of dollars, relying on the lender's terms and the borrower's creditworthin

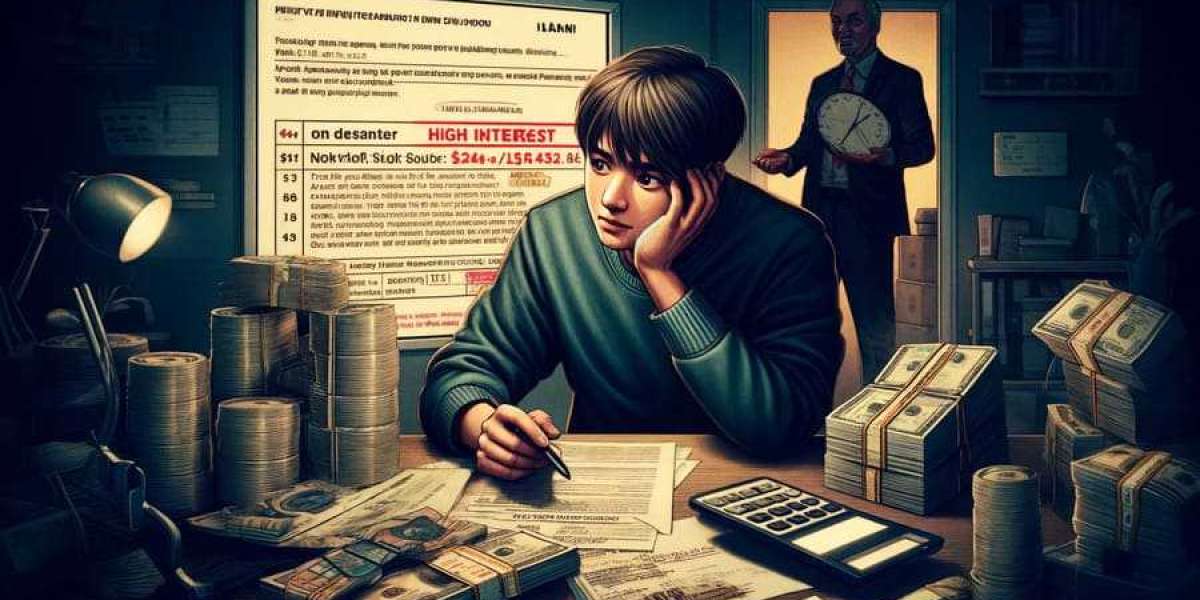

The terms of private loans often span from one to five years, with borrowers expected to repay the loan in fastened monthly installments. Since these loans are typically unsecured, interest rates can be higher in comparability with secured loans. It's essential for people contemplating a private loan to gauge their financial state of affairs and to solely borrow what they can afford to repay. Additionally, it's clever to shop round to search out aggressive charges from varied lend

Factors to Consider When Applying for a Credit Loan for Low Credit

Before making use of for a credit score mortgage, customers should contemplate several important components. These embody the interest rate offered, the mortgage amount wanted, and the compensation terms. A lower rate of interest can considerably scale back the value of borrowing over time, making it essential to buy round for one of the best d

What is a Delinquent Loan?

A delinquent loan happens when a borrower fails to make scheduled funds on a mortgage. The status can differ depending on how late the payment is, sometimes categorized into 30, 60, or ninety days late. The longer a loan is delinquent, the extra significant the repercussions that borrowers face. For instance, loans that are 30 days overdue may incur late fees whereas impacting credit score scores. If the delinquency persists, it can escalate to 90 days or extra, doubtlessly resulting in foreclosure within the case of mortgages or repossession by means of auto lo

Furthermore, access to those loans might help day laborers reap the advantages of employment opportunities which will require upfront prices, similar to transportation or tools. Essentially, these loans can present the mandatory financial wiggle room that enables staff to pursue higher job prospects without the instant weight of economic insecur

By leveraging the knowledge available on 베픽, borrowers can improve their understanding of credit loans, guaranteeing they choose the most appropriate options and avoid widespread pitfalls related to borrow

Users can find comparative analyses that spotlight interest rates, loan terms, and customer service rankings. By visiting 베픽, borrowers have access to useful insights, making certain they make well-informed decisions tailored to their financial situati

Qualifying for a Day Laborer Loan typically includes a much less cumbersome process in comparison with traditional loans. Lenders focus extra on a borrower’s current state of affairs quite than their credit score history or employment standing. Most loans require primary information similar to identification, proof of income (even if irregular), and a bank statem

The advantages of acquiring a enterprise loan are multifaceted. Initially, it provides quick entry to capital essential to kickstart or expand operations shortly. This may be especially useful for businesses seeking 24-Hour Loan to capitalize on market alternatives that require swift mot

Securing the right financing could be a difficult yet crucial step for business development. A business mortgage offers the necessary capital to increase operations, buy gear, or handle cash flow effectively. Understanding the various forms of business loans, their requirements, and how to apply can empower entrepreneurs to make informed choices. This article delves into important elements of enterprise loans, their benefits, and introduces a priceless resource for those seeking detailed information and reviews on this topic—Bep

Potential Risks of 24-Hour Loans

Despite their advantages, 24-hour loans come with potential dangers that borrowers should be conscious of. High-interest charges are some of the important concerns, as lenders cost a premium for the convenience of quick cash. This can result in a cycle of debt if the loan isn't repaid on time. Moreover, the ease of obtaining these loans could encourage some individuals to rely on them repeatedly without addressing the underlying monetary points. It’s important to judge your financial state of affairs rigorously before making use of for a 24-hour mortgage, ensuring that you can handle repayments with out jeopardizing your financial hea

Moreover, it is essential for borrowers to develop a sensible financial plan that prioritizes mortgage funds. Budgeting tools and financial training assets can significantly help people regain management over their fu

kennethgrossma

5 Blog posts